According to the Vietnam Association of Seafood Exporters and Producers (VASEP), Vietnam's pangasius export market in the first eight months of 2025 has shown signs of divergence, but also notable bright spots. August 2025 witnessed several key developments. While exports to China and Hong Kong declined slightly by 4%, reaching USD 55 million, many other markets continued to show strong performance.

Frozen Fillets Remain Key Product, Processed Items Gain Momentum

Vietnam’s pangasius exports to the U.S. reached USD 234 million over the eight-month period, up 3.7% year-on-year. Despite the modest growth, the U.S. remains a key market due to its high-value demand, strict requirements, and global influence. Maintaining positive growth amid tariffs and technical barriers signals that Vietnamese pangasius is steadily strengthening its position in the mid- to high-end segment. This also serves as a motivation for exporters to continue standardizing operations and building long-term brand recognition.

In the CPTPP bloc, Vietnam earned USD 242 million from pangasius exports during the same period, up 36% compared to the previous year. Japan, Canada, and Mexico are among the most important markets, with diverse demand ranging from frozen fillets to value-added products. Tax incentives from the trade agreement and consumer trends favoring convenient, safe foods have opened significant room for growth. As a result, the CPTPP bloc is considered not just a short-term bright spot but a long-term strategic region.

The ASEAN region is playing an increasingly important role in the landscape of Vietnam’s pangasius exports. In the first eight months of the year, Thailand imported USD 52 million worth of pangasius, up 31%, while the Philippines reached USD 26 million, also up 31%. Malaysia and Singapore maintained stable growth. With advantages such as geographic proximity, lower logistics costs, and similar taste preferences, ASEAN is becoming a “safety belt” for Vietnam’s pangasius industry, helping reduce dependence on distant and more demanding markets.

In the EU market, pangasius exports brought in USD 120 million in the eight-month period, a 6% increase. Although growth remains modest, the EU is still considered a high-value market with strong influence on brand perception. Steady demand for high-standard pangasius fillets in Germany, the Netherlands, and Spain suggests long-term potential. However, to fully capitalize on this market, exporters must meet requirements on sustainability certification, traceability, and green consumption trends.

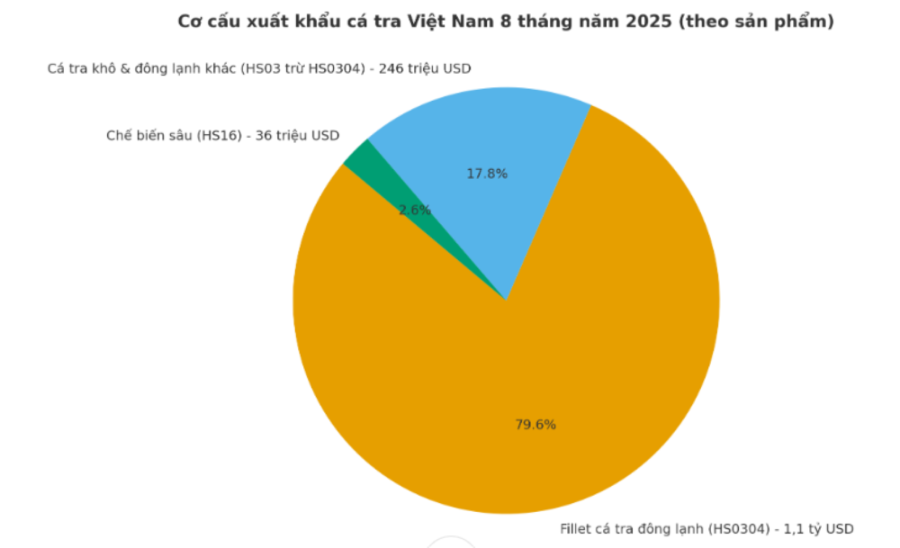

In the product structure of Vietnam’s pangasius exports during the first eight months of 2025, frozen pangasius fillets (HS code 0304) remained the core product, with export value exceeding USD 1.1 billion, up 11% year-on-year. In addition, other dry and frozen pangasius products (HS code 03, excluding 0304) reached USD 246 million, a modest increase of 2%.

Notably, deeply processed pangasius products (HS code 16), including canned, smoked, marinated, pre-cooked, spiced frozen products, surimi, and other food preparations, recorded strong growth despite accounting for a small share of total exports. As of the end of August, exports of pangasius under HS16 reached USD 36 million, a surge of 32% year-on-year. This growth reflects the industry's quick adaptation to growing market demands for convenience, product diversity, and added value.

Pangasius Prices Rebound Amid Limited Supply

Another key development is the recovery of pangasius prices. Entering September 2025, export prices have risen due to limited raw fish supply and low survival rates of fry. Many farmers are choosing to hold off on selling, waiting for better prices. Unfavorable weather conditions, including heavy rains and temperature fluctuations, have pushed up farming costs, reinforcing the upward trend in prices. At the same time, limited fry supply has led to reluctance among farmers to sell smaller fish, contributing to shortages through the end of August. With current prices at their highest in three years, it is expected that once processors finish using their stockpiles, purchase prices from farmers will continue to rise.

According to VASEP, Vietnam’s pangasius industry faces both opportunities and challenges heading into the final quarter of the year. In the U.S. market, starting August 2025, a 20% countervailing duty has been imposed on Vietnamese pangasius imports. Buyers remain cautious, focusing on clearing inventory rather than placing new orders, keeping demand subdued. The long-term effects of the new tariff remain uncertain.

In China, purchasing activity has slowed in recent months, particularly for whole pangasius and frozen fillets. While average prices have improved slightly, inventory fluctuations warrant close monitoring of this market.

Meanwhile, the EU and CPTPP markets are expected to remain pillars of growth, supported by tariff advantages and steady demand. Export prices to the EU may have bottomed out in late August and are forecast to rebound from September onward due to tightening supply. The ASEAN region continues to offer growth potential, backed by steady consumption, geographical proximity, and low logistics costs. South America and the Middle East are also seen as promising alternatives to reduce reliance on the U.S. and China.

However, VASEP believes that opportunities remain open if Vietnamese exporters leverage free trade agreements with the EU and CPTPP while intensifying efforts to penetrate potential markets like ASEAN, South America, and the Middle East. Market diversification, expansion of processed product lines, and brand building in higher-value segments are considered key strategies for sustaining growth. With favorable price trends, the industry has a solid foundation to aim for over USD 2 billion in exports by the end of 2025.

Source: vneconomy.vn